A combination of economic, demographic, and social factors precipitated Oxy's endowment woes throughout the 1990s. Now the balance sheet is far better—but the College has a long way to go to catch up to its institutional peers

By Jim Tranquada | Illustration by Anders Wenngren

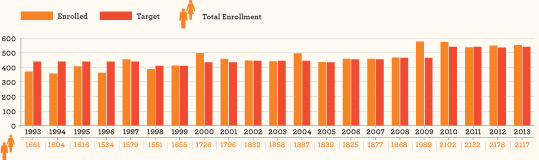

First, the good news about Occidental's endowment: Oxy's total annual return for the 2012-13 fiscal year was 12 percent, slightly above the national average of 11.7 percent of 461 U.S. colleges and universities as calculated by the National Association of College and Business Officers. (The NACUBO average includes all 69 of the country's billion-dollar-plus institutional endowments—including Harvard's $32.7 billion.) It's the 10th consecutive year that Oxy's endowment has outperformed the national average—even during the market implosion of 2009, when every institution's investments took a big hit.

"We have a very strong group of alumni on the Board of Trustees' investment committee who are very well-versed in the field, and whose decisions have been based on the long term—identifying what our fundamental priorities are and sticking to them," says committee chair Chris Varelas '85, partner in the Bay Area firm Riverwood Capital, a private equity firm that manages almost $1 billion invested in the tech industry. "The most surprising thing about our performance is that preservation of capital is very high on our priority list, and we've been able to get a good return while being fairly conservative in our investment strategy."

And now, the could-be-better news: Despite its sterling record of returns over the last decade, the size of Occidental's endowment continues to lag behind its peers. Totaling $356.8 million as of June 30, 2013, the Oxy endowment is roughly $100 million less than the average of the College's official peer comparison group of 16 liberal arts colleges, removing the outliers at the top (Pomona's $1.67-billion endowment) and bottom (Pitzer's $113.7-million portfolio).

"There are no quick fixes for what is at least a 40-year problem," says Larry Caldwell, Cecil H. and Louise Gamble Professor in Political Science and coauthor of 1988 and 1993 reports on College finances from the faculty Subcommittee on Finance. "We need the concentrated best thinking of administration, faculty, and financially savvy trustees to turn the slopes of Oxy's endowment curve in a positive direction relative to our competition."

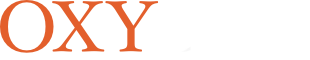

Currently, only 16 percent of Occidental's annual operating budget ($97.8 million in the 2013 fiscal year) comes from revenue generated by the endowment. Last year, gifts to the College and revenues from food service, housing, and other sources totaled another 8 percent. The rest—76 percent—comes entirely from tuition. That makes Occidental much more vulnerable to the vagaries of student recruitment, in which one year's failure to reach target enrollments can have serious budget consequences. (At Pomona, the endowment produces more than half of the annual operating budget.)

"Whether it's keeping faculty salaries competitive, providing generous scholarships, keeping roofs from leaking, or supporting student and faculty research, a healthy endowment can make all the difference," says President Jonathan Veitch. "Historically, the College has increased enrollment as a way to address budgetary issues, and that is no longer a viable alternative. We have to grow Occidental's endowment. This will continue to be one of our top fundraising priorities."

While much of the work of putting together Oxy's annual budget takes place out of the public eye, there is one aspect that draws headlines every year—U.S. News & World Report's annual college rankings. Average spending per student is one metric: "Generous per-student spending indicates that a college can offer a wide variety of programs and services," according to U.S. News' methodology. A recent analysis by Hanna Spinosa, assistant dean for academic affairs and head of Oxy's Office of Institutional Research, Assessment, and Planning, found a direct correlation between the size of a college endowment and its U.S. News ranking. "For every $17.6-million increase in your endowment, you can expect to see a 1-point improvement in your ranking," she says.

In 1988, when Richard Gilman stepped down after 23 years as Oxy's president, he left behind an endowment that had grown from $15.1 million to almost $127 million during his tenure. A 1990 Commonfund study found that only eight other college and university endowments had grown at a faster rate. There was every reason to take an optimistic view of the future: The endowment produced a remarkable 20 percent return in 1988-89, Oxy received a then-record number of applications for the Class of 1992, and enrollment was at an eight-year high.

So what happened?

When the 1989-90 academic year drew to a close and the College ended up with a small deficit of $233,000, it drew little attention. "Since 1937, the College has balanced its annual operating budget, and the Board and administration intend to continue to do so in the future," the College confidently stated in its reaccreditation report that year. But the shortfall (covered by unrestricted gifts) proved to be a harbinger of things to come—a perfect storm of economic, demographic, and social factors that led to a decade of multi-million-dollar budget deficits and a fateful 1992 decision to use the endowment to staunch the flow of red ink.

What President John Slaughter and the Board of Trustees did not anticipate was the stubborn recession of the late '80s and early '90s, which hit financial markets and middle-class families hard and produced large government deficits that led to cuts in state and federal financial aid programs. The recession also struck at the same time the number of Americans of traditional college-going age began to shrink. The result: increased competition for a smaller pool of prospective students, and greater pressure on the College to increase financial aid to appeal to families squeezed by the recession.

Applications to Oxy continued to grow until 1992, when the L.A. riots broke out; over the next five years, applicants plummeted by almost one-third, as the 1994 Northridge earthquake gave out-of-state families yet another reason to have second thoughts about Los Angeles. Equally worrisome was the fact that the size of the entering class fell short of its target for several years, leaving tuition-dependent Oxy short of its principal source of operating revenue.

Adding to the financial pressures was the soaring cost of the College's need-blind financial aid program, which had more than doubled in the decade prior to Slaughter's arrival, from 11 percent of the operating budget to 24 percent. The result, Slaughter told the board in December 1993, was that the increase in financial aid spending "has escaped the boundaries of reasonableness." (Oxy's current financial aid program is not need-blind, but meets 100 percent of the demonstrated need of all students.)

The recession also posed a major challenge to Oxy's small five-person fundraising operation, which historically had focused on foundation and corporate giving—an approach reflected in the makeup of the Board of Trustees. (In 1989, less than one-third of trustees were Oxy graduates; today, more than three-quarters are.) Although 36 percent of alumni gave to the College in 1984-85 during the final phase of a Gilman-led capital campaign, that number dropped to 25 percent five years later, just as recession-driven competition for increasingly scarce corporate and foundation funding ramped up. Annual fundraising results were modest compared to other liberal arts colleges: In 1987-88, when Oxy raised a total of $6.9 million, Colorado College's nine-person staff raised $8.6 million, Swarthmore's 16-person staff raised $12.5 million, and Pomona's 14-person staff reeled in a whopping $33.7 million in gifts. "It is essential that Occidental more aggressively reach out to individuals—specifically, alumni and friends of the college—for a significant share of future support," the Strategic Planning Task Force on Institutional Advancement recommended in 1990.

Every college and university endowment suffered from the effects of the recession. But the impact was particularly pronounced at Occidental because of the Board's decision to substantially increase the endowment's real estate portfolio just as Slaughter took office—from almost 20 percent in 1987 to more than 34 percent at the end of 1988. By December 1992, the market value of the real estate portfolio had dropped by $3 million. The overall market value of the endowment actually declined from 1990 to 1993, and the overall annual return, which consistently outperformed the national average in the late 1980s, fell well below it beginning in 1990.

In the spring of 1992, when the board decided with the agreement of faculty to make a limited draw on the quasi-endowment—that portion of the endowment established by the College—no one anticipated the scope or cost of the challenges that lay ahead. It wasn't the first time the board had taken that route, having regularly dipped into quasi-endowment funds since 1983-84 for a variety of reasons, including the funding of capital projects, bonded indebtedness, and an employee mortgage loan program. But what was originally intended as a four-year, $2.6-million program to keep the budget in the black until full enrollment was reached turned into a decade-long struggle to balance the budget.

"The effects of underenrollment, an underperformance of the endowment, and the unusually large expenditures in financial aid created a situation that was unsustainable," Slaughter said in a 1996 campus message. "Faculty, administrator, and staff salaries were frozen; positions were eliminated and layoffs were incurred; and needed maintenance was further deferred in order to continue a robust financial aid budget. Even so, the College has experienced budgetary deficits for six of the last eight years. The effects of the confluence of these events has discouraged donors and foundations from making gifts and grants to the College."

By spring 2001, when the chronic deficit problem had finally been solved, the board had drawn 10 times the amount it originally intended out of quasi-endowment—about $26 million. Had that money remained in the investment pool, it would likely have added anywhere from $60 million to $70 million to the value of today's endowment, estimates Amos Himmelstein, vice president for planning and finance. Occidental's endowment did grow during the 1990s, from $147.2 million in 1990 to $280.6 million in 2000, a gain of 91 percent. While that outperformed Macalester's endowment (which grew just 76 percent), it fell far short of other schools that took advantage of the bull market of the latter part of the decade, including Whitman (up 214 percent), Pomona (272 percent), and Carleton (287 percent).

The recent success of the Board's investment committee—which draws on the expertise of alumni such as Varelas, Pete Adamson '84 (who manages Oprah Winfrey's personal investments), venture capitalists Dave Berkus '62 and Ron Hahn '66, and Rob Neihart '87, who heads the Capital Groups' research arm—is based on a conscious change in strategy.

Promoted by past committee chair Ian McKinnon '89, partner in New York-based Ziff Brothers Investments, "it's a more modern strategy, a thoughtful move toward improved asset allocation and investing in an alternative program, closer to the Yale model," which diversifies a portfolio into less-liquid investments with a higher rate of return, Varelas says. "Previously, it appears that the College was perhaps more willing to chase a return of the moment, rather than grounding its strategy in fundamental, long-term priorities." The results have been consistent: Oxy's five-year average annual return of 4.4 percent (a period that includes the market crash) and 10-year average of 8.4 percent outperformed a group of five dozen schools with endowments of a similar size (chart, left).

As successful as that approach has been, Occidental cannot catch up to the competition through investment returns alone, Hahn says: "We have to win in fundraising." As at any college, the chief fundraiser is the president, and "Jonathan not only understands the importance of fundraising, he is good at it," says Shelby Radcliffe, who joined the College as vice president for institutional advancement in March 2012. She points to the lengthy list of fully-funded projects completed during his first four years, including the renovation and expansion of Swan Hall; the creation of the Rose Hills Foundation Student Activities Center; the transformation of Johnson Hall into the McKinnon Center for Global Affairs; the new Samuelson Alumni Center; and new endowments for technology, student counseling services, and the Career Development Center.

"Increasing the size of the endowment and our overall financial resources is critical to the success of Oxy's strategic plan," Veitch says. "Positioning our fundraising efforts to be successful has taken up a lot of my time and energy, but I think we've made real progress." Back-to-back years of gifts and pledges to the College in excess of $20 million are evidence that this approach is paying off, he adds.

In September, the Board approved Radcliffe's plan for a major expansion of the College's institutional advancement efforts. The addition of 11 new positions will bring staffing more in line with Oxy's peers and provide the resources needed to substantially increase the College's fundraising capacity.

At the top of Radcliffe's list is a drive to build the scholarship endowment. She is optimistic about the support that the Oxy community will give to the century-old tradition of increasing funds for financial aid (which impacts 74 percent of the current enrollment). "Alumni and parents want to make sure the best and the brightest can attend Oxy, regardless of their ability to pay," she says. "When we ask for help to keep this mission alive and well, as well as to expand it, I believe the response will be amazing."