Andrew Jalil is an economist, whose research is in two distinct areas: (1) macroeconomic history (financial crises, monetary and fiscal policy, the Great Depression) and (2) food policy (health, sustainability).

Andrew Jalil is the 2025 recipient of the Linda and Tod White Teaching Prize.

On October 18, 2025, during Homecoming & Family Weekend, Professor Andrew Jalil gave a lecture on Federal Reserve Independence, as part of the Celebrating Our Shared Legacy of Excellence in Economics event.

Convocation Address Fall 2018

Research

Macroeconomics and Economic History

"Germany's Anti-Inflationary Monetary Policy, 1945-73", with Kirsten Wandschneider (working paper coming soon), revise and resubmit at the Journal of Economic History

Abstract. We adopt a historical narrative approach to study the emergence of Germany’s Stabilitätskultur, the anti-inflationary ethos that shaped German monetary policy in the post-WW2 era. First, using contemporaneous news accounts from 1945-73, we examine the evolution of German opinion about monetary policy, in terms of conflicting goals (inflation vs growth) and sentiments (anti-inflationary vs anti-deflationary) and questions about the sovereignty of the central bank (independence vs limits). We find evidence of persistent anti-inflationary goals and sentiments throughout the full period, but disagreement initially about the importance of central bank independence, followed by a swing in public opinion towards monetary autonomy in 1956-57. Second, we identify the policy actions that the German central bank took to reinforce its anti-inflationary goals and the consequences of those actions. Monetary authorities repeatedly took preemptive actions to combat anticipatory increases in inflation. These actions led to significant declines in output and inflation and increases in unemployment.

"A New Chronology of Bubbles in the United States, 1825-1929: Construction and Implications", with Matthew Botsch (working paper coming soon)

We construct a new, representative chronology of bubbles in the U.S. in 1825–1929 using a narrative approach. We read all relevant articles from more than a century of leading business newspapers to identify bubbles based on contemporaneous descriptions, and we investigate implications for macroeconomic history and policy. Easing monetary conditions are robustly associated with bubble formation. Deflating bubbles are not directly associated with output declines on average. However, deflating bubbles are associated with a higher likelihood of banking panics, especially bubbles that are broad in scope, centered in real estate, and accompanied by credit booms.

A New History of Banking Panics in the United States, 1825-1929: Construction and Implications, American Economic Journal: Macroeconomics.

Abstract. There are two major problems in identifying the output effects of banking panics of the pre-Great Depression era. First, it is not clear when panics occurred because prior panic series differ in their identification of panic episodes. Second, establishing the direction of causality is tricky. This paper addresses these two problems (i) by deriving a new panic series for the 1825-1929 period and (ii) by studying the output effects of major banking panics via vector autoregression (VAR) and narrative-based methods. The new series has important implications for the history of financial panics in the United States.

Monetary Intervention Really Did Mitigate Banking Panics During the Great Depression: Evidence Along the Atlanta Federal Reserve District Border, Journal of Economic History.

Abstract. This paper argues that monetary intervention alleviated banking panics during the early stages of the Great Depression. Throughout the course of the depression, the Federal Reserve Bank of Atlanta aggressively intervened to stabilize its banking system. To assess the effectiveness of these policies, I analyze the performance of banks along counties straddling the border of the Atlanta Federal Reserve District. My results indicate that expansionary initiatives designed to inject liquidity into the banking system reduced the incidence of bank suspensions by 32 to 48% in some regions. Moreover, an analysis of the balance sheets of individual Federal Reserve Districts suggests that liquidity intervention did not expend large resources and that a concerted, system-wide interventionist policy response was feasible during the first half of the depression.

Comparing Tax and Spending Multipliers by Controlling for Monetary Policy, International Journal of Economics and Business Research.

Abstract. This paper derives empirical estimates for aggregate tax and spending multipliers. To deal with endogeneity concerns, I employ a large sample of fiscal consolidations identified through the narrative approach. To control for monetary policy, I study the output effects of fiscal consolidations in countries where monetary authorities are constrained in their ability to counteract shocks because they are in either a monetary union (and hence, lack an independent central bank) or a liquidity trap. My empirical estimates suggest that for fiscal consolidations, the tax multiplier is larger than the spending multiplier. The estimated tax multiplier is large—on the order of 3, suggesting strongly negative effects of tax increases on output.

Media Coverage: The Market Monetarist

Inflation Expectations and Recovery in Spring 1933, Explorations in Economics History.

Abstract. This paper uses the historical narrative record to determine whether inflation expectations shifted during the second quarter of 1933, precisely as the recovery from the Great Depression took hold. First, by examining the historical news record and the forecasts of contemporary business analysts, we show that inflation expectations increased dramatically. Second, using an event-studies approach, we identify the impact on financial markets of the key events that shifted inflation expectations. Third, we gather new evidence — both quantitative and narrative — that indicates that the shift in inflation expectations played a causal role in stimulating the recovery.

Media Coverage: Banque De France, Interview with Nobel Economist Christopher Sims, Kocherlakota's Thoughts on Policy, The Faint of Heart, The Market Monetarist, Uneasy Money, FEDS Note

Inflation Expectation in the U.S. in Fall 1933, Research in Economic History

Abstract. This paper documents how inflation expectations evolved in the United States during the fall of 1933 using narrative evidence from historical news accounts and the forecasts of contemporary business analysts. We find that inflation expectations, after rising substantially during the spring of 1933, moderated in the fall in response to mixed messages from the Roosevelt Administration. The narrative accounts and our econometric model connect the dramatic swings in output growth in 1933 — the rapid recovery in the spring and the setback in the fall — to these sudden movements in inflation expectations.

Food Policy

Low-cost climate-change informational intervention reduces meat consumption among students for 3 years, Nature Food

Abstract. Evidence on the impact of information campaigns on meat consumption patterns is limited. Here, using a dataset of more than 100,000 meal selections over 3 years, we examine the long-term effects of an informational intervention designed to increase awareness about the role of meat consumption in climate change. Students randomized to the treatment group reduced their meat consumption by 5.6 percentage points with no signs of reversal over 3 years. Calculations indicate a high return on investment even under conservative assumptions (~US$14 per metric ton CO2eq). Our findings show that informational interventions can be cost effective and generate long-lasting shifts towards more sustainable food options.

Media Coverage: New Scientist, Phys.org, Business Insider India, Samarchar Central, Sentient Media, Yahoo News

Eating to Save the Planet: Evidence from a Randomized Controlled Trial Using Individual-Level Food Purchase Data, Food Policy

Abstract. Meat consumption is a major driver of climate change. Interventions that reduce meat consumption may improve public health and promote environmental sustainability. We conducted a randomized controlled trial to examine the effects of an awareness-raising intervention on meat consumption. We randomized undergraduate classes into treatment and control groups. Treatment groups received a 50-minute lecture on how food choices affect climate change, along with information about the health benefits of reduced meat consumption. Control classrooms received a lecture on a placebo topic. We analyzed 49,301 students’ meal purchases in the college dining halls before and after the intervention. We merged food purchase data with survey data to study heterogenous treatment effects and disentangle mechanisms. Participants in the treatment group reduced their purchases of meat and increased their purchases of plant-based alternatives after the intervention. The probability of purchasing a meat-based meal fell by 4.6 percentage points (p < 0.01), whereas the probability of purchasing a plant-based meal increased by 4.2 percentage points (p = 0.04). While the effects were stronger during the semester of the intervention, dietary shifts persisted and remained statistically significant through the full academic year. Our study provides evidence that an intervention based on informing consumers and encouraging voluntary shifts can effectively reduce the demand for meat. Our findings help to inform the international food policy debate on how to counter rising global levels of meat consumption to achieve climate change goals. To our knowledge, our study is the first to assess the effectiveness of an educational intervention to reduce meat consumption using such high-quality data (i.e. individual-level food purchases) over a prolonged period.

Changing Hearts and Plates: The Effect of Animal-Advocacy Pamphlets on Meat Consumption, Frontiers in Psychology

Social movements have driven large shifts in public attitudes and values, from anti-slavery to marriage equality. A central component of these movements is moral persuasion. We conduct a randomized-controlled trial of pro-vegan animal-welfare pamphlets at a college campus. We observe the effect on meat consumption using an individual-level panel data set of approximately 200,000 meals. Our baseline regression results, spanning two academic years, indicate that the pamphlet had no statistically significant long-term aggregate effects. However, as we disaggregate by gender and time, we find small statistically significant effects within the semester of the intervention: a 2.4 percentage-point reduction in poultry and fish for men and a 1.6 percentage-point reduction in beef for women. The effects disappear after 2 months. We merge food purchase data with survey responses to examine mechanisms. Those participants who (i) self-identified as vegetarian, (ii) reported thinking more about the treatment of animals or (iii) expressed a willingness to make big lifestyle changes reduced meat consumption during the semester of the intervention. Though we find significant effects on some subsamples in the short term, we can reject all but small treatment effects in the aggregate.

Teaching

Principles of Economics (Fall 2011)

Senior Seminar (Spring 2017)

Courses

- Monetary Policy and Financial Markets (Econ 495)

- Politics and Fiscal Policy (Econ 316)

- Intermediate Macroeconomic Theory (Econ 251)

- Principles of Economics (Econ 101)

Monetary Policy and Financial Markets (Econ 495)

This course examines the interaction between monetary policy and financial markets. Key topics include business cycles, stock and bond markets, and banking panics. Students will learn how to analyze the financial market implications of Federal Reserve policy. The course incorporates insights from economic history to understand the monetary policy challenges facing the U.S. macroeconomy today. Prerequisite: Econ 251.

Politics and Fiscal Policy (Econ 316)

This course examines the role of politics in influencing fiscal policy and the latest empirical research on the effects of fiscal policy. We will use case studies of important episodes from U.S. macroeconomic history as a window for analysis. The course emphasizes current fiscal policy debates facing the U.S. Congress and President today. Prerequisite: Econ 102

Intermediate Macroeconomic Theory (Econ 251)

This course is devoted to answering the fundamental questions macroeconomists study. Why are some countries rich and others poor? What causes economic growth? Why do we have recessions and what can policymakers do to fight them?

Students will develop a strong understanding of modern macroeconomic theory and empirical macroeconomic analysis. The course will focus on both long-run and short-run macroeconomic issues. Topics include economic growth, income inequality, unemployment, inflation, stabilization policy, government debt and deficits, international trade, exchange rates and financial crises. Special emphasis is placed on developing economic tools and applying those tools to understanding contemporary macroeconomic issues and policy debates. Prerequisite: Economics 102.

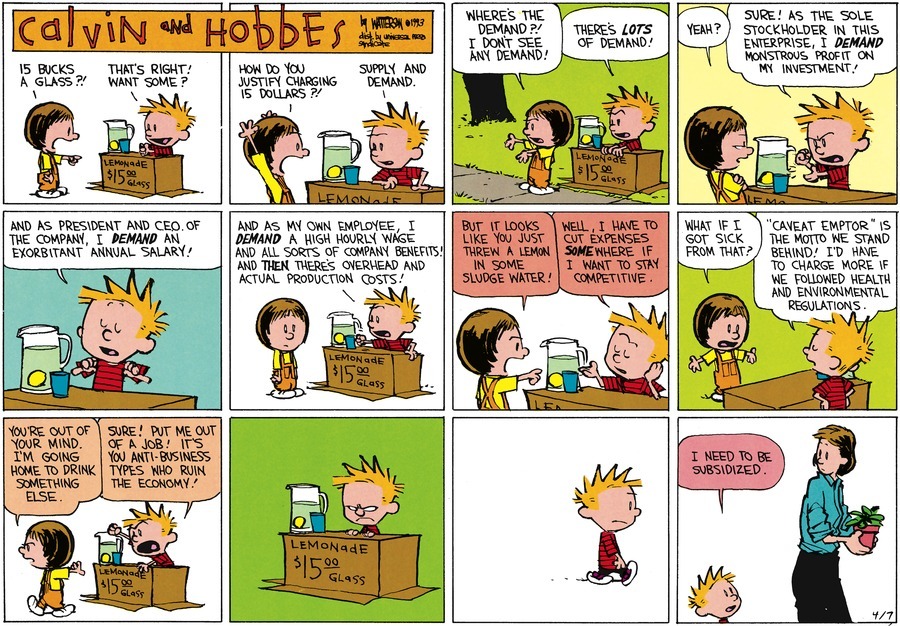

Principles of Economics (Econ 101)

This course provides an introduction to economics. It examines both microeconomics, the study of the behavior of individual consumers and firms, and macroeconomics, the study of the aggregate economy. Special emphasis is placed on developing economic theory and applying economic tools to contemporary policy issues.

Economics and Occidental-Related Photos